In the modern era, technology is rapidly advancing, with automation taking center stage in numerous industries. While this advancement brings significant benefits, it also introduces a new set of cybersecurity challenges. As our world becomes increasingly interconnected, businesses and individuals are more vulnerable to cyberattacks, making cybersecurity insurance crucial for mitigating potential financial losses.

This article delves into the critical topic of cybersecurity in the age of automation, exploring the evolving landscape of cyber threats and the significance of comprehensive insurance policies. We will examine the unique vulnerabilities introduced by automated systems and highlight how insurance can provide a safety net for organizations navigating the complexities of a connected world.

The Rise of Cybersecurity Threats in an Automated World

The rapid adoption of automation technologies, while promising increased efficiency and productivity, has inadvertently ushered in a new era of cybersecurity threats. As more processes become interconnected and reliant on data exchange, the attack surface expands, creating lucrative targets for cybercriminals.

One of the most significant concerns is the increasing reliance on interconnected systems. Automation often involves multiple devices and systems working together, creating a complex network of vulnerabilities. A breach in one system could potentially compromise the entire chain, leading to significant disruptions and financial losses.

Furthermore, the growth of Internet of Things (IoT) devices presents a unique challenge. These devices, often lacking robust security measures, become entry points for attackers to gain access to sensitive data and networks. The proliferation of IoT devices, coupled with their limited processing power and security capabilities, creates a perfect storm for cybercriminals.

Another crucial factor is the rise of sophisticated AI-powered attacks. Malicious actors are increasingly employing artificial intelligence to automate attacks, making them more targeted, personalized, and difficult to detect. AI-powered malware can adapt and evolve rapidly, bypassing traditional security measures and causing significant damage.

The automation revolution has undoubtedly brought immense benefits, but it has also introduced a new breed of cybersecurity threats. Organizations must understand the evolving landscape and implement comprehensive security measures to protect themselves in this increasingly connected world.

Understanding Cybersecurity Insurance Policies

In today’s interconnected world, where automation and digital transformation are rapidly changing the landscape, it’s more crucial than ever to safeguard your business against cyber threats. One essential component of a comprehensive cybersecurity strategy is cybersecurity insurance. These policies provide financial protection and support in the event of a cyberattack, helping you minimize potential losses and recover more quickly.

Cybersecurity insurance policies cover a wide range of risks, including:

- Data breaches: Coverage for costs associated with data breaches, such as notification, credit monitoring, and legal expenses.

- System failures: Protection against financial losses resulting from system outages, network disruptions, and data loss.

- Cyber extortion: Coverage for ransom demands and other extortion attempts related to cyberattacks.

- Regulatory fines and penalties: Financial protection against penalties imposed by regulatory bodies due to data breaches or non-compliance.

- Business interruption: Coverage for lost revenue and other expenses incurred during a cyberattack-related business disruption.

When choosing a cybersecurity insurance policy, it’s essential to consider several factors, including:

- Coverage limits: The maximum amount of financial protection provided by the policy.

- Deductible: The amount you’re responsible for paying before the insurance coverage kicks in.

- Exclusions: Specific events or circumstances that are not covered by the policy.

- Claims process: The procedure for filing and handling claims under the policy.

- Reputation of the insurer: The financial stability and track record of the insurance company.

Cybersecurity insurance is an essential tool for businesses operating in the digital age. By understanding the coverage, risks, and factors involved in choosing a policy, you can make an informed decision that best suits your organization’s needs and safeguards your business against the evolving threat landscape.

Coverage and Benefits

As automation increasingly permeates our lives, the risk of cyberattacks grows alongside. Cybersecurity insurance is crucial in this connected world, offering protection against financial losses and reputational damage. These policies provide coverage for a wide range of incidents, including:

- Data breaches: Protecting businesses from the costs associated with data theft, notification, and recovery.

- System failures: Covering expenses related to system outages, downtime, and restoration.

- Cyber extortion: Offering financial assistance and legal support in cases of ransomware attacks.

- Third-party liability: Protecting businesses from lawsuits stemming from cyberattacks against their clients or partners.

- Business interruption: Covering lost revenue and expenses due to operational disruptions caused by cyberattacks.

Beyond financial coverage, cybersecurity insurance provides numerous benefits, including:

- Risk mitigation: Encouraging businesses to implement robust cybersecurity measures to qualify for coverage.

- Expert support: Access to specialized legal, forensic, and technical experts in case of a cyberattack.

- Reputation management: Helping businesses manage public relations and mitigate reputational damage after an incident.

- Peace of mind: Providing assurance that businesses are protected against the financial and operational consequences of cyberattacks.

Types of Cyber Risks Covered

Cyber insurance policies are designed to protect businesses and individuals from a wide range of cyber risks. While specific coverage varies by insurer and policy, here are some of the most common types of cyber threats addressed:

Data Breaches and Security Incidents

These policies often cover losses arising from data breaches, including:

- Data theft, whether it involves personal information, financial data, or intellectual property.

- System failures, such as malware attacks, ransomware, or denial-of-service attacks.

- Data recovery and restoration costs, including incident response services and legal expenses.

Business Interruption and Loss of Income

Cyberattacks can disrupt business operations, causing significant financial losses. Cyber insurance policies may cover:

- Lost revenue due to downtime or inability to conduct business.

- Extra expenses incurred to restore operations, such as hiring temporary staff or setting up alternative systems.

- Loss of customers and damage to reputation resulting from a cyber incident.

Privacy Liability

Data breaches can lead to lawsuits and regulatory fines related to privacy violations. Cyber insurance provides coverage for:

- Legal defense costs arising from data privacy claims.

- Regulatory fines and penalties imposed by government agencies.

- Notification costs for informing individuals affected by a data breach.

Cyber Extortion

Ransomware attacks and other cyber extortion schemes are becoming increasingly common. Cyber insurance policies can cover:

- Ransom payments, although some insurers may have limits or exclusions.

- Negotiation and crisis management to help businesses handle cyber extortion threats.

- Data recovery costs if data is encrypted or held hostage by attackers.

It’s important to note that cyber insurance policies are not a complete solution to all cyber risks. They are designed to mitigate financial losses, but businesses and individuals still need to invest in strong cybersecurity measures to prevent attacks in the first place.

Data Breach Response and Recovery

In the interconnected world of automation, where data flows freely, the risk of a data breach looms large. A breach can disrupt operations, damage reputation, and incur significant financial costs.

Insurance policies can play a crucial role in mitigating the impact of a data breach. Policies often cover:

- Forensic investigation: Determining the extent of the breach and identifying the cause.

- Notification costs: Informing affected individuals and regulatory bodies.

- Credit monitoring: Helping victims protect their financial information.

- Legal and regulatory expenses: Addressing potential lawsuits and compliance issues.

- Business interruption costs: Recovering lost revenue and expenses incurred during downtime.

Beyond financial protection, insurance policies can provide valuable support:

- Expert assistance: Access to cybersecurity professionals who can guide your response.

- Crisis management support: Helping you manage public relations and communications during a crisis.

- Vendor management: Ensuring third-party vendors comply with security standards.

Data breach response and recovery is not just about insurance; it’s about preparedness. Having a robust security program, strong incident response plans, and comprehensive insurance coverage can help you navigate the challenges of a data breach and minimize the damage.

Business Interruption Coverage

In the digital age, automation is transforming businesses, making them more efficient and interconnected. However, this increased reliance on technology also exposes companies to new risks, particularly those associated with cybersecurity threats. Business interruption coverage, a crucial aspect of insurance policies, plays a vital role in safeguarding companies against financial losses resulting from cyberattacks.

Business interruption insurance is designed to cover the loss of income a business experiences when it is unable to operate due to unforeseen circumstances, such as a cyberattack. This coverage goes beyond simply replacing damaged equipment or data. It helps businesses recover by covering expenses such as lost revenue, payroll, and additional operating costs incurred while restoring operations.

In the context of cybersecurity, business interruption coverage is essential for mitigating the financial impact of various cyber incidents, including:

- Data breaches: A data breach can lead to significant financial losses, including legal fees, regulatory fines, and customer compensation. Business interruption insurance can help cover these expenses, along with the costs of restoring data and systems.

- Ransomware attacks: Ransomware attacks can cripple businesses by encrypting their data and demanding payment for its decryption. Business interruption coverage can help cover the ransom demands and the costs of recovering data and systems.

- Distributed Denial of Service (DDoS) attacks: DDoS attacks can overwhelm a business’s website and other online services, making them inaccessible to customers. Business interruption insurance can cover the lost revenue and the costs of mitigating the attack.

When considering business interruption coverage, it is crucial to ensure that the policy adequately addresses the unique cybersecurity risks facing your business. Look for policies that specifically cover:

- Cyber extortion: This covers financial losses incurred due to threats of data disclosure or system disruption.

- Data recovery: This covers the costs of restoring data and systems after a cyberattack.

- Business income: This covers lost revenue during the period of disruption.

- Extra expenses: This covers additional operating costs incurred while restoring operations, such as temporary staff and alternative facilities.

By carefully evaluating your cybersecurity risks and selecting a comprehensive business interruption insurance policy, companies can significantly mitigate the financial impact of cyberattacks. This proactive approach ensures business continuity and resilience in the increasingly complex and interconnected world of automation.

Cyber Liability and Legal Expenses

In the age of automation, where technology permeates every aspect of our lives, businesses are increasingly vulnerable to cyber threats. A cybersecurity incident can have devastating consequences, ranging from data breaches and financial losses to reputational damage and legal ramifications. This is where cyber liability insurance comes into play, offering crucial protection against the financial fallout of cyberattacks.

Cyber liability insurance typically covers a wide range of expenses associated with cyber incidents, including:

- Legal expenses: This covers the cost of legal representation in the event of lawsuits stemming from a data breach or other cyber incident.

- Data breach response costs: This includes expenses related to notifying affected individuals, credit monitoring services, and forensic investigations.

- Business interruption losses: This covers lost revenue and other expenses incurred due to downtime resulting from a cyberattack.

- Cyber extortion payments: This covers ransom payments demanded by hackers in exchange for the release of stolen data or the restoration of systems.

Beyond these core coverage areas, cyber liability insurance policies may also include additional protections, such as:

- Privacy violation coverage: This covers the costs associated with violations of privacy laws, such as the General Data Protection Regulation (GDPR).

- Cybercrime coverage: This covers losses arising from cybercrime, such as phishing scams and malware attacks.

- Social engineering coverage: This covers losses arising from social engineering attacks, such as phishing emails and phone scams.

In today’s interconnected world, cyber liability insurance is no longer a luxury but a necessity for businesses of all sizes. It provides vital financial protection against the growing threat of cyberattacks, ensuring that businesses can recover and rebuild in the aftermath of an incident.

Why Autonomous Vehicles Need Cybersecurity Insurance

The rise of autonomous vehicles (AVs) marks a significant shift in the automotive industry, promising enhanced safety, efficiency, and convenience. However, with increased connectivity comes the heightened risk of cybersecurity threats. As AVs rely heavily on complex software and communication networks, they become vulnerable to cyberattacks that can compromise their operations, potentially leading to accidents, data breaches, and financial losses.

Cybersecurity insurance plays a crucial role in mitigating these risks for AV manufacturers, operators, and consumers. It provides financial protection against various cybersecurity incidents, including:

- Data breaches: Protecting sensitive user data like driving habits, location information, and personal details.

- System malfunctions: Covering costs associated with repairing or replacing damaged AV systems.

- Liability claims: Providing insurance against legal claims arising from accidents caused by cyberattacks.

- Business interruption: Supporting financial losses incurred due to system outages or operational disruptions.

The need for cybersecurity insurance for AVs is driven by several factors:

- Growing sophistication of cyberattacks: Hackers are increasingly targeting connected vehicles, with sophisticated attacks becoming more common.

- Lack of established cybersecurity standards: The automotive industry is still developing comprehensive cybersecurity standards for AVs, leaving vulnerabilities open to exploitation.

- Potential for widespread damage: A successful cyberattack on an AV fleet could have cascading effects, impacting multiple vehicles and potentially causing significant disruption.

By acquiring cybersecurity insurance, AV manufacturers and operators can:

- Transfer risk: Shift the financial burden of cyberattacks to insurance providers.

- Boost investor confidence: Demonstrate their commitment to cybersecurity and mitigate potential financial risks.

- Protect their reputation: Minimize reputational damage associated with cyber incidents.

As the adoption of AVs accelerates, cybersecurity insurance will become an essential component of the automotive ecosystem. It provides a crucial safety net for stakeholders, offering financial protection against emerging cybersecurity threats in the age of automation.

Unique Risks Faced by Connected and Autonomous Vehicles

The rapid adoption of connected and autonomous vehicles (CAVs) has ushered in a new era of mobility, but it also presents a unique set of cybersecurity risks. These risks are amplified by the interconnected nature of CAVs, which rely on complex networks of sensors, software, and communication systems to operate.

Unlike traditional vehicles, CAVs are susceptible to a variety of cyberattacks that can compromise their safety and functionality. Some of the most significant risks include:

- Remote hijacking: Hackers can remotely take control of a CAV’s steering, acceleration, and braking systems, potentially leading to accidents.

- Data manipulation: Attackers can tamper with sensor data, causing the vehicle to misinterpret its surroundings and make incorrect decisions.

- Denial of service: Hackers can disrupt the communication between a CAV and its infrastructure, preventing it from receiving vital information or updates.

- Software vulnerabilities: Security flaws in a CAV’s software can create vulnerabilities that hackers can exploit to gain access to the vehicle’s systems.

- Data theft: CAVs collect vast amounts of personal data, including location, driving habits, and payment information, which is vulnerable to theft.

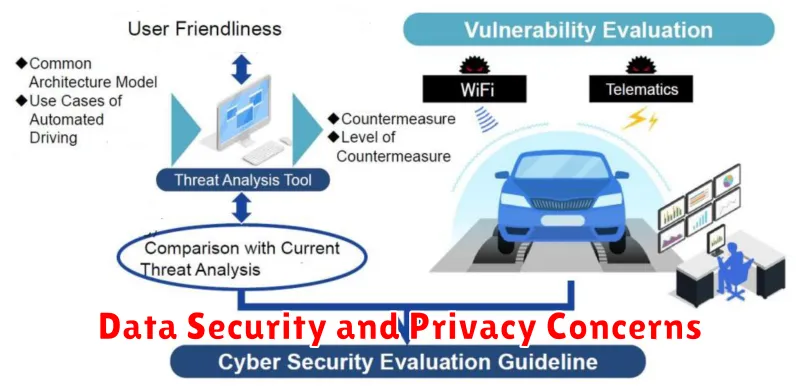

Data Security and Privacy Concerns

As automation continues to permeate all aspects of our lives, the interconnected nature of the modern world presents significant challenges to data security and privacy. The increasing reliance on connected devices, cloud-based services, and artificial intelligence (AI) creates an expansive digital landscape vulnerable to cyber threats.

One of the primary concerns is the potential for data breaches and unauthorized access to sensitive information. With interconnected systems, a breach in one system can potentially compromise multiple others, leading to widespread data loss or theft. This presents a serious risk to both individuals and organizations, potentially exposing personal details, financial data, and intellectual property.

Furthermore, the growing use of AI raises concerns about privacy violations. AI algorithms can analyze vast amounts of data, often without explicit consent, potentially revealing sensitive information about individuals. There are concerns about potential misuse of this data for targeted advertising, discriminatory practices, or even surveillance.

Navigating these challenges requires a proactive approach to data security and privacy. Organizations must implement robust security measures, including strong encryption, access control, and regular security audits. Individuals also need to be aware of potential risks and take steps to protect their data, such as using strong passwords, avoiding phishing scams, and being mindful of the information they share online.

Liability Issues in Case of Accidents

In the realm of automation, where interconnected systems seamlessly drive our daily lives, ensuring cybersecurity takes on paramount importance. While the benefits of automation are undeniable, the potential for accidents due to cybersecurity breaches cannot be ignored. This poses critical liability issues that demand careful consideration.

A crucial aspect to consider is the liability chain. When an automated system malfunctioning due to a cybersecurity breach causes harm, establishing responsibility can be complex. For instance, who is liable if a self-driving car crashes due to a hack – the car manufacturer, the software developer, the network provider, or even the individual who accessed the system? This intricate web of interconnected entities necessitates clear guidelines for determining liability.

Furthermore, the nature of automation introduces new challenges. Automated systems often operate autonomously, making it difficult to pinpoint the exact cause of an accident. Traditional liability frameworks may not be readily applicable in such situations. This calls for innovative solutions to address the evolving legal landscape.

One approach is to establish a framework for shared liability, where all parties involved in the development, deployment, and maintenance of an automated system share responsibility for its safe operation. This could involve robust cybersecurity protocols, comprehensive insurance coverage, and clear guidelines for incident response and damage control.

To mitigate the risks associated with cybersecurity breaches in automation, cybersecurity insurance is becoming increasingly crucial. Such insurance policies can help cover costs related to data breaches, system downtime, legal defense, and regulatory fines. However, it is essential to carefully evaluate the scope of coverage and ensure it adequately addresses the unique liability issues associated with automated systems.

As we navigate this interconnected world, proactively addressing liability issues related to cybersecurity breaches in automation is vital. Establishing clear guidelines, exploring innovative liability frameworks, and leveraging robust insurance solutions are crucial steps towards mitigating risks and fostering trust in this rapidly evolving technological landscape.

Regulatory Requirements and Industry Standards

As automation takes center stage in the modern world, the interconnected nature of our systems necessitates robust cybersecurity measures. Regulatory requirements and industry standards play a crucial role in shaping the landscape of cyber risk management. Organizations must navigate a complex web of regulations, including GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and NIST Cybersecurity Framework, to ensure the protection of sensitive data.

Furthermore, adherence to industry standards like ISO 27001 (Information Security Management System) and PCI DSS (Payment Card Industry Data Security Standard) demonstrates a commitment to best practices in cybersecurity. These standards provide a framework for implementing security controls, managing risks, and demonstrating compliance.

In the realm of insurance, understanding regulatory requirements and industry standards is paramount. Insurance companies are increasingly incorporating cybersecurity provisions into their policies, emphasizing the importance of proactive risk mitigation. By adhering to these standards, organizations can not only demonstrate responsible data handling but also potentially qualify for favorable insurance terms.

Choosing the Right Cybersecurity Insurance Policy

In our increasingly automated world, businesses are more connected than ever before. This connectivity brings great benefits but also exposes organizations to new and evolving cybersecurity threats. As a result, cybersecurity insurance has become increasingly important for businesses of all sizes.

Choosing the right cybersecurity insurance policy can be daunting. Here’s a breakdown of key factors to consider:

1. Assess Your Risk

Before you start shopping for policies, take a comprehensive look at your organization’s cybersecurity risks. Consider factors like:

- The types of data you store and process

- Your IT infrastructure and security measures

- Your industry and regulatory compliance requirements

- Your business continuity plans

2. Determine Your Coverage Needs

Once you’ve assessed your risks, you can determine what kind of coverage you need. Common cybersecurity insurance coverages include:

- First-party coverage: Protects your business against direct losses from a cyberattack, such as data breach costs, business interruption, and system restoration.

- Third-party coverage: Covers your liability to others, such as customers or clients, for damages caused by a cyberattack.

- Cyber extortion coverage: Protects you against financial losses from ransomware attacks.

- Data breach response coverage: Helps you with the costs of notifying affected individuals and managing a data breach.

3. Compare Policies and Providers

Get quotes from multiple insurance providers and carefully compare their policies. Look for factors like:

- Coverage limits: The maximum amount the insurer will pay for a claim.

- Deductibles: The amount you pay out-of-pocket before the insurance kicks in.

- Exclusions: Specific risks or events that are not covered by the policy.

- Premium costs: The annual cost of the policy.

- Claims handling process: How the insurer handles claims and the level of support they provide.

4. Consult with a Cybersecurity Expert

Consider working with a cybersecurity expert to help you navigate the insurance process. They can help you understand your risks, identify the right coverage, and negotiate favorable terms with insurers.

Choosing the right cybersecurity insurance policy is crucial for protecting your business in the digital age. By carefully considering your risks, coverage needs, and policy options, you can find a policy that provides adequate protection for your organization.

Factors to Consider for Autonomous Vehicle Coverage

As we delve deeper into the age of automation, the integration of autonomous vehicles (AVs) into our transportation systems is becoming increasingly prevalent. This technological advancement brings a new set of challenges, particularly in the realm of cybersecurity. Insurance policies must evolve to address the unique risks associated with AVs, and understanding the crucial factors for coverage is paramount.

Liability and Responsibility: One of the most significant considerations is determining liability in the event of an accident involving an AV. Traditional insurance models often assign responsibility to the driver, but in the case of AVs, the algorithm itself may be deemed responsible. Policies need to clearly define the roles and responsibilities of the manufacturer, operator, and the AV’s software in the event of an incident.

Data Security and Privacy: AVs collect vast amounts of data, including personal information, location data, and driving patterns. This data is highly sensitive and must be protected against cyberattacks. Insurance policies should include provisions for data breach protection, covering potential losses related to data theft, misuse, or unauthorized access.

Cyberattacks and Software Vulnerabilities: AVs rely heavily on complex software systems, which are vulnerable to cyberattacks. Policies should provide coverage for damages caused by malicious attacks, software glitches, or security breaches that lead to accidents or system failures.

Cybersecurity Measures: Insurance providers should encourage the adoption of robust cybersecurity measures by AV manufacturers and operators. This might include requirements for regular security audits, software updates, and encryption protocols to mitigate the risk of cyberattacks.

Emerging Technologies: As AV technology continues to evolve, insurance policies need to be adaptable to accommodate new features and functionalities. This includes coverage for emerging risks, such as remote control capabilities, advanced driver-assistance systems (ADAS), and vehicle-to-vehicle (V2V) communication.

By carefully considering these factors and implementing comprehensive insurance policies, we can pave the way for a safer and more secure future for autonomous vehicles. As we navigate the evolving landscape of cybersecurity in the age of automation, ensuring adequate insurance coverage is a critical step towards fostering public trust and promoting the widespread adoption of this transformative technology.

Future Trends in Cybersecurity Insurance for Automation

As automation continues to reshape industries, cybersecurity concerns are escalating. The interconnected nature of automated systems creates new vulnerabilities, requiring a shift in cybersecurity insurance policies. This shift will focus on addressing the unique risks associated with automation and ensuring adequate coverage for businesses in a rapidly evolving digital landscape.

Expanding Coverage for Automation-Specific Threats

Traditional cybersecurity insurance often falls short in addressing the intricacies of automated systems. Future policies will likely encompass a wider range of automation-specific threats, including:

- AI-driven attacks: Insurers will need to account for sophisticated attacks exploiting artificial intelligence vulnerabilities.

- Data manipulation and theft: Automated systems handle massive datasets, making them prime targets for data manipulation and theft.

- System outages and disruptions: The interconnectedness of automated systems increases the impact of outages, requiring more comprehensive coverage.

- Supply chain vulnerabilities: Automation relies on interconnected networks, making supply chain security crucial, and insurance will reflect this.

Data Security and Privacy Protection

Automated systems often collect and process sensitive data, making data security and privacy a paramount concern. Insurance policies will need to include enhanced coverage for:

- Data breach response costs: Including costs for notifying affected individuals, forensic investigations, and legal fees.

- Data recovery and restoration: Covering the expenses associated with restoring data compromised due to cyberattacks.

- Reputational damage: Protecting businesses from the financial implications of data breaches affecting their reputation.

Emerging Technologies and Risk Assessment

The rapid pace of technological innovation poses new challenges to cybersecurity. Future insurance policies will need to be flexible enough to adapt to emerging technologies, such as:

- Quantum computing: Insurers will need to consider the potential impact of quantum computers on encryption and data security.

- Internet of Things (IoT): The proliferation of connected devices introduces new attack vectors, requiring dedicated coverage.

- Edge computing: The distributed nature of edge computing necessitates new approaches to risk assessment and coverage.

Proactive Security Measures and Risk Mitigation

Cybersecurity insurance will increasingly incentivize proactive security measures and risk mitigation strategies. This might involve:

- Discounts for robust cybersecurity practices: Rewarding businesses that implement strong security protocols.

- Coverage for security audits and vulnerability assessments: Encouraging regular security evaluations to identify and address vulnerabilities.

- Training and awareness programs: Supporting employee education and awareness around cybersecurity risks.

The future of cybersecurity insurance for automation lies in its ability to adapt to the ever-evolving threat landscape. By embracing a proactive and comprehensive approach, insurance can play a vital role in empowering businesses to navigate the challenges and opportunities of a connected world.