In today’s digital age, where transactions occur with a click of a button and personal information is constantly being shared online, the threat of fraud is more real than ever. Fraudsters are constantly evolving their tactics, making it increasingly difficult for businesses and individuals to stay ahead of the curve. Fortunately, advancements in artificial intelligence (AI) are providing powerful new tools to combat this growing threat. AI-powered fraud detection tools are revolutionizing the way we protect ourselves from financial losses and safeguard our sensitive data.

This article delves into the exciting world of AI-powered fraud detection, exploring how these cutting-edge technologies are being used to outsmart fraudsters. We’ll examine the key features and functionalities of these tools, discuss the benefits they bring to both businesses and individuals, and explore the future of AI in the fight against fraud. Whether you’re a business owner concerned about protecting your customer data or an individual looking to secure your own finances, this article will provide valuable insights into the power of AI in combating fraud.

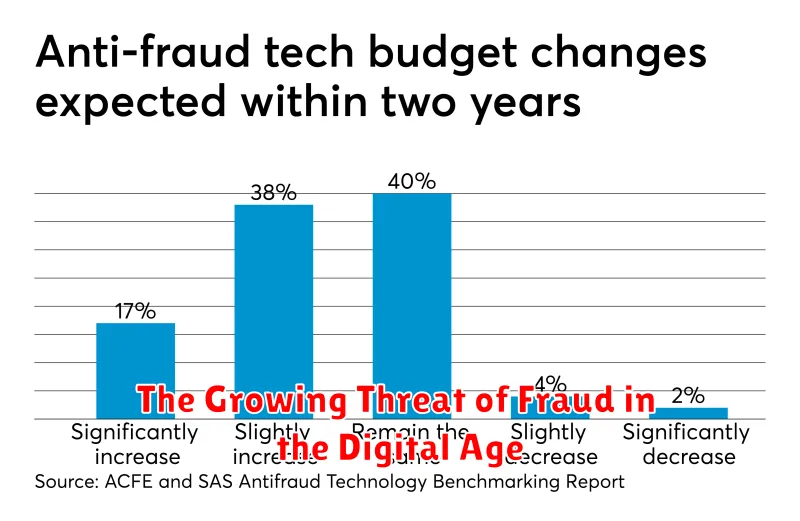

The Growing Threat of Fraud in the Digital Age

The digital age has revolutionized the way we live, work, and interact. While it has brought countless benefits, it has also opened up new avenues for fraudsters. As our lives become increasingly interconnected, the threat of fraud is growing at an alarming rate.

With the rise of e-commerce, online banking, and digital payments, criminals have a vast and ever-expanding landscape to exploit. Sophisticated fraud techniques, such as identity theft, phishing scams, and online credit card fraud, are becoming increasingly common. These sophisticated techniques leverage advanced technologies to target unsuspecting victims and steal their hard-earned money.

Moreover, the increasing availability of personal data online makes it easier for fraudsters to identify potential targets. Data breaches, social engineering tactics, and the exploitation of vulnerabilities in online platforms all contribute to the growing vulnerability of individuals and businesses to fraud.

The consequences of fraud can be devastating. Victims may experience financial losses, identity theft, and reputational damage. Businesses may face significant financial losses, legal repercussions, and damage to their brand reputation. It is crucial to recognize the growing threat of fraud in the digital age and take proactive measures to protect ourselves.

How AI is Transforming Fraud Detection

Fraud detection has always been a cat-and-mouse game, with fraudsters constantly evolving their tactics. But with the rise of artificial intelligence (AI), the playing field is shifting dramatically. AI-powered fraud detection tools are offering a new level of sophistication, enabling businesses to outsmart fraudsters and protect their bottom line.

One of the key ways AI is transforming fraud detection is through its ability to analyze vast amounts of data in real time. Traditional methods often struggled to keep up with the sheer volume of transactions and data points. AI algorithms, however, can process information at lightning speed, identifying subtle patterns and anomalies that might escape human scrutiny. This real-time analysis allows businesses to detect fraudulent activity before it causes significant damage.

Another advantage of AI is its ability to learn and adapt. As fraudsters develop new strategies, AI models can continuously update their detection algorithms, staying one step ahead of the curve. This adaptive learning allows businesses to stay ahead of evolving fraud trends and prevent them from becoming victims of sophisticated scams.

AI is also revolutionizing the way businesses manage risk and allocate resources. By identifying high-risk transactions and individuals, AI-powered systems can help companies focus their efforts where they are most needed. This targeted approach allows businesses to optimize their fraud prevention strategies and reduce the costs associated with false positives and manual reviews.

In conclusion, AI is transforming fraud detection in a fundamental way. Its ability to analyze data, learn and adapt, and optimize risk management makes it an invaluable tool for businesses looking to protect themselves from financial loss and reputational damage. As AI continues to evolve, we can expect even more innovative solutions to emerge, further empowering businesses to outsmart fraudsters and create a safer digital environment.

Types of AI-Powered Fraud Detection Tools

In the digital age, fraud is a constant threat, and businesses need to stay ahead of the game to protect themselves and their customers. AI-powered fraud detection tools offer a powerful solution, leveraging machine learning and advanced analytics to identify and prevent fraudulent activities.

Here are some key types of AI-powered fraud detection tools:

1. Machine Learning-Based Fraud Detection

These tools use algorithms to analyze historical data and identify patterns that indicate fraudulent behavior. By learning from past transactions, they can predict future fraud attempts and flag suspicious activity. Supervised learning models are trained on labeled data, while unsupervised learning models identify anomalies and outliers.

2. Behavioral Analytics

Behavioral analytics tools monitor user behavior and identify deviations from normal patterns. These tools can track factors such as login times, purchase history, and browsing patterns to detect suspicious activity. Real-time analysis allows for immediate detection and response.

3. Network Analysis

Network analysis tools examine the relationships between different entities, such as users, accounts, and transactions. They identify clusters and patterns that might indicate fraudulent activity. This approach can uncover complex fraud schemes involving multiple individuals or organizations.

4. Rule-Based Systems

While not purely AI-driven, rule-based systems still play a vital role in fraud detection. These systems use predefined rules and thresholds to flag suspicious activities. They are effective for detecting known fraud patterns but may struggle with evolving or novel tactics.

5. Biometric Authentication

Biometric authentication, such as facial recognition or fingerprint scanning, can be used to verify user identity and prevent unauthorized access to accounts. These tools add an extra layer of security and can deter fraudsters.

The Future of AI-Powered Fraud Detection

AI-powered fraud detection is continuously evolving. As fraudsters become more sophisticated, so too will the technology used to combat them. Expect to see advances in areas such as:

- Deep learning models for more accurate and nuanced fraud detection.

- Hybrid systems combining AI and rule-based approaches for greater effectiveness.

- Real-time fraud prevention through proactive measures.

- Advanced anomaly detection to identify even the most subtle signs of fraud.

Benefits of Using AI for Fraud Prevention

In today’s digital age, fraud is a growing concern for businesses and individuals alike. Fraudsters are constantly evolving their tactics, making it increasingly difficult to detect and prevent fraudulent activity. Fortunately, Artificial Intelligence (AI) is emerging as a powerful tool in the fight against fraud. AI-powered fraud detection systems offer a range of benefits that can help organizations stay ahead of the curve and protect themselves from financial losses.

One of the primary benefits of using AI for fraud prevention is its ability to analyze vast amounts of data at lightning speed. AI algorithms can process transactions, customer behavior, and other relevant information to identify patterns and anomalies that might indicate fraudulent activity. Traditional methods of fraud detection often rely on manual analysis, which is time-consuming and prone to errors. AI can automate this process, allowing organizations to detect fraud in real-time and take action before significant damage is done.

Another key advantage of AI is its ability to learn and adapt over time. As AI systems are exposed to more data, they become increasingly adept at identifying new and emerging fraud techniques. This adaptability is crucial in an environment where fraudsters are constantly changing their methods. AI can keep pace with these changes, helping to ensure that organizations are always one step ahead.

Moreover, AI can help to reduce false positives, which are instances where legitimate transactions are incorrectly flagged as fraudulent. False positives can be costly, leading to customer frustration and lost revenue. AI algorithms can be trained to identify legitimate transactions with high accuracy, minimizing the number of false positives and improving the overall efficiency of fraud prevention efforts.

In conclusion, AI is revolutionizing the fight against fraud. Its ability to analyze data, learn and adapt, and reduce false positives makes it an indispensable tool for organizations looking to protect themselves from financial losses. By embracing AI-powered fraud detection systems, organizations can gain a significant edge in the battle against fraudsters and ensure the security of their operations.

Real-World Applications of AI in Fraud Detection

The rise of sophisticated fraudsters demands equally sophisticated solutions. Artificial intelligence (AI) has emerged as a powerful tool in the fight against fraud, offering real-world applications that are revolutionizing how organizations detect and prevent financial crime.

Financial Services: AI is widely used by banks and financial institutions to detect fraudulent transactions in real-time. Machine learning algorithms analyze vast amounts of data, identifying unusual spending patterns, suspicious account activity, and potential identity theft. This proactive approach helps prevent financial losses and protect customer funds.

E-commerce: Online shopping platforms rely heavily on AI to combat fraud. AI-powered tools analyze user behavior, purchase history, and shipping information to detect fraudulent orders. This helps identify fake accounts, prevent credit card abuse, and ensure secure transactions for both sellers and buyers.

Healthcare: The healthcare industry is also leveraging AI to prevent fraudulent claims and protect patient data. AI algorithms can analyze medical billing records, identify anomalies, and flag potential instances of insurance fraud. They can also monitor patient data for signs of identity theft and protect sensitive medical information.

Insurance: Insurance companies use AI to detect fraudulent claims and protect against financial losses. AI algorithms analyze claims data, identifying patterns of fraud, suspicious claims, and potential collusion. This helps insurers make informed decisions, prevent payouts to fraudulent claims, and maintain financial stability.

The application of AI in fraud detection is constantly evolving, with new technologies and approaches emerging all the time. By embracing these powerful tools, organizations can stay ahead of fraudsters, protect their customers, and ensure a secure and trustworthy environment for all.

Key Features to Look for in AI Fraud Detection Tools

Fraud is a significant problem for businesses of all sizes. According to a recent study, businesses lose an average of 5% of their revenue to fraud each year. As a result, there is a growing demand for AI-powered fraud detection tools.

AI fraud detection tools use machine learning algorithms to identify suspicious activity. These algorithms can learn from past data to detect patterns that indicate fraud. They can also adapt to new fraud techniques as they emerge.

Here are some key features to look for in AI fraud detection tools:

Real-time Detection and Analysis

Fraudsters are constantly developing new methods, so it’s important to have a tool that can detect suspicious activity in real time. This allows you to take action before any damage is done.

Machine Learning & Artificial Intelligence

AI-powered tools utilize advanced machine learning algorithms to analyze vast amounts of data, identifying subtle patterns and anomalies that could signal fraudulent activity. The ability to learn from historical data and adapt to evolving fraud techniques is crucial for effective detection.

Comprehensive Data Analysis

A good AI fraud detection tool will be able to analyze data from multiple sources, such as your website, mobile app, and payment gateway. This gives you a more complete picture of potential fraud activity.

User-Friendly Interface

The tool should be easy to use and understand. This is important for both your fraud analysts and your business stakeholders.

Scalability

As your business grows, your fraud detection tool should be able to scale with it. It should be able to handle increasing volumes of data and transactions without sacrificing performance.

Integration with Existing Systems

The tool should be able to integrate with your existing systems, such as your CRM, ERP, and payment gateway. This will make it easier to implement and use.

By choosing an AI fraud detection tool with these features, you can significantly reduce your risk of fraud and protect your business.

Choosing the Right AI Fraud Detection Solution for Your Business

In today’s digital landscape, fraudsters are becoming increasingly sophisticated, making it harder for businesses to protect themselves. Thankfully, artificial intelligence (AI) is emerging as a powerful tool in the fight against fraud. AI-powered fraud detection solutions can analyze vast amounts of data in real-time, identify suspicious patterns, and flag potential fraudulent activities. However, with so many options available, choosing the right AI fraud detection solution for your business can be a daunting task.

To navigate this complex decision, it’s essential to consider several key factors:

1. Type of Fraud You’re Targeting

Different AI solutions specialize in detecting specific types of fraud. For example, some solutions are designed to prevent credit card fraud, while others focus on insurance claims fraud or online account takeover. It’s crucial to identify the types of fraud your business is most vulnerable to and select a solution that addresses those specific risks.

2. Data Integration and Compatibility

The AI solution you choose should seamlessly integrate with your existing systems and data sources. Consider the data formats your solution supports, as well as its ability to handle real-time data streams. A solution that can easily access and analyze your data will be more effective in detecting fraud.

3. Scalability and Performance

As your business grows, so too will your data volume and the potential for fraud. Ensure the solution you choose can scale to accommodate your future needs. Consider its processing power, latency, and ability to handle large datasets without compromising performance.

4. Customizable Rules and Alerts

A good AI fraud detection solution should offer customizable rules and alerts to tailor its functionality to your specific requirements. This allows you to define thresholds for suspicious activity, set up specific alerts, and customize the solution to meet your unique needs.

5. User-Friendliness and Reporting

The solution should be easy to use and understand, even for non-technical users. Look for solutions with clear dashboards, intuitive reporting tools, and comprehensive documentation. The ability to generate detailed reports on fraud trends and patterns can be invaluable for improving your fraud prevention strategies.

6. Cost and ROI

Finally, consider the cost of the solution and its potential return on investment. While more expensive solutions may offer advanced features, it’s important to weigh the benefits against the cost. Evaluate the solution’s potential to reduce fraud losses, improve efficiency, and enhance customer satisfaction.

By carefully considering these factors, you can choose the right AI fraud detection solution that aligns with your business needs and helps you outsmart fraudsters.

Implementing and Integrating AI Fraud Detection Systems

In today’s digital landscape, fraudsters are constantly evolving their tactics, making it increasingly challenging for businesses to stay ahead of the curve. Fortunately, artificial intelligence (AI) is emerging as a powerful weapon in the fight against fraud. AI-powered fraud detection systems offer unprecedented capabilities, enabling businesses to identify and prevent fraudulent activity with greater accuracy and efficiency than ever before.

Implementing and integrating AI fraud detection systems requires a strategic approach. Here are key considerations for a successful deployment:

Data Collection and Preparation

AI algorithms thrive on data. Businesses need to gather relevant data from various sources, including transactional history, customer profiles, and external data sources. This data must be cleansed, normalized, and structured for optimal AI model training.

Model Selection and Training

Choosing the right AI model is crucial. Supervised learning models, such as decision trees and neural networks, are well-suited for fraud detection. Training these models involves feeding them large datasets of historical fraud and non-fraud transactions to enable them to learn patterns and anomalies.

Integration and Deployment

The AI fraud detection system must be seamlessly integrated into existing business systems. This might involve integrating the system with customer relationship management (CRM) platforms, payment gateways, or other relevant applications. Deployment should be staged to allow for testing and fine-tuning before full-scale implementation.

Continuous Monitoring and Improvement

AI models need to be constantly monitored and improved. This involves tracking the system’s performance, identifying false positives and false negatives, and retraining models with new data to adapt to evolving fraud trends.

Security and Privacy

Data security and privacy are paramount. Businesses must ensure that AI fraud detection systems comply with relevant regulations and industry best practices. Secure data storage, access controls, and data anonymization techniques are essential.

By implementing and integrating AI fraud detection systems effectively, businesses can significantly reduce their exposure to fraud. AI technology provides a powerful tool for outsmarting fraudsters and safeguarding their financial well-being.

Ensuring Data Security and Privacy in AI Fraud Detection

While AI-powered fraud detection tools offer immense potential in combating financial crime, it’s crucial to address the concerns surrounding data security and privacy. These tools rely on vast amounts of sensitive data, making it imperative to implement robust safeguards.

Data Minimization: Only collect and process the data absolutely necessary for fraud detection. Avoid gathering unnecessary information, reducing the risk of exposure.

Encryption: Implement strong encryption techniques to protect data both at rest and in transit. This ensures that even if unauthorized access occurs, the data remains unreadable.

Access Control: Implement granular access controls to limit access to sensitive data to authorized personnel. This prevents unauthorized individuals from accessing and potentially misusing sensitive information.

Data Masking: Mask or anonymize sensitive data used for training AI models. This protects sensitive information while still allowing the model to learn patterns and detect fraudulent activities.

Regular Audits: Conduct regular security audits to assess the effectiveness of data security measures and identify potential vulnerabilities.

Transparency and Consent: Be transparent about data collection and usage practices. Obtain informed consent from individuals whose data is being processed for fraud detection purposes.

By implementing these measures, organizations can leverage the power of AI in fraud detection while safeguarding data security and privacy. This ensures that these tools effectively combat fraud without compromising the trust of customers and stakeholders.

The Future of Fraud Detection: AI’s Continued Evolution

The fight against fraud is a constant battle, with fraudsters constantly evolving their tactics. Fortunately, the field of fraud detection is also rapidly evolving, thanks to the power of artificial intelligence (AI). AI-powered tools are becoming increasingly sophisticated, offering a powerful weapon in the fight against financial crime.

AI’s ability to analyze vast amounts of data in real-time and identify patterns that humans might miss is revolutionizing fraud detection. Traditional methods often rely on rule-based systems, which are static and can be easily bypassed by sophisticated fraudsters. AI, on the other hand, is able to learn and adapt, constantly updating its models to stay ahead of evolving threats.

Here are some key areas where AI is driving the future of fraud detection:

- Enhanced Anomaly Detection: AI algorithms can detect unusual activity patterns in real-time, flagging suspicious transactions before they can cause significant damage.

- Real-time Risk Assessment: AI models can assess the risk associated with individual transactions, enabling organizations to prioritize investigations and allocate resources effectively.

- Automated Fraud Investigation: AI can automate many aspects of fraud investigations, freeing up investigators to focus on more complex cases.

- Predictive Analytics: AI models can predict future fraud attempts based on historical data, allowing organizations to take proactive steps to mitigate risk.

While the use of AI in fraud detection is promising, it’s crucial to address the potential challenges. AI models require continuous training and updates to stay effective, and organizations must invest in robust data security to protect sensitive information.

The future of fraud detection will be increasingly defined by AI. As technology continues to evolve, AI-powered tools will become even more powerful, enabling organizations to stay one step ahead of fraudsters and protect their customers and their bottom line.