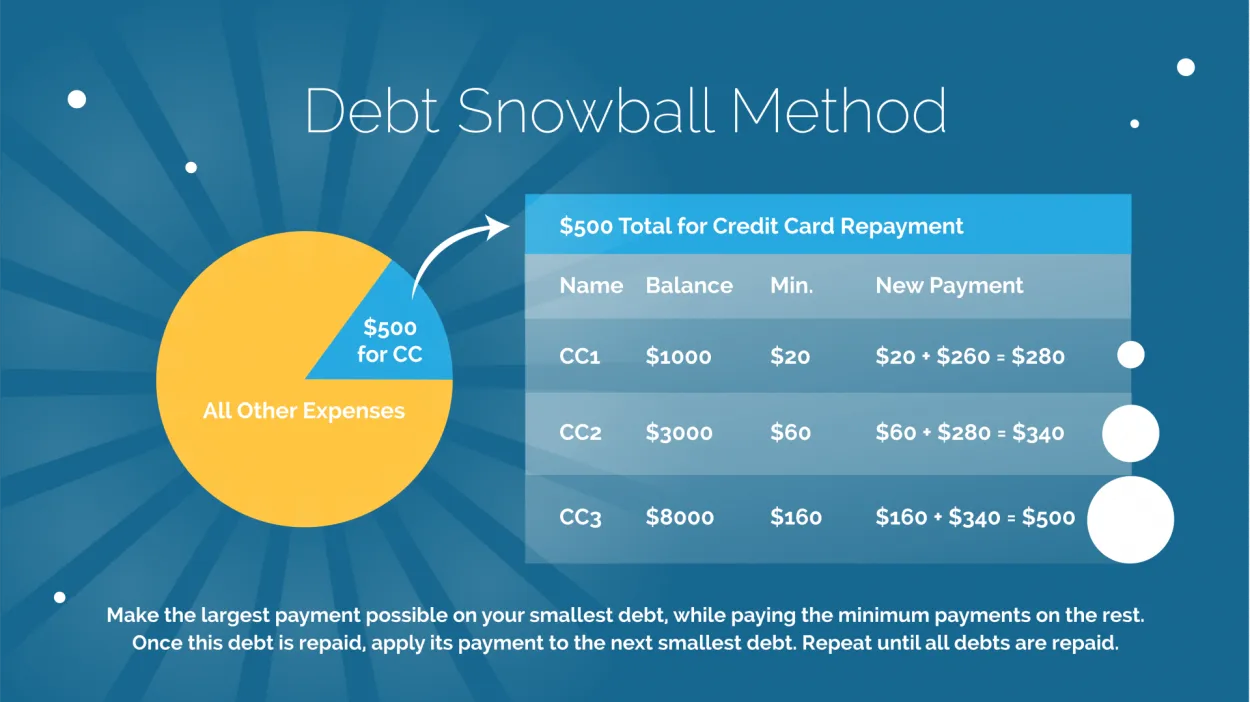

The Debt Snowball Method is a strategic approach to debt reduction that focuses on paying off smaller debts first, creating momentum to tackle larger ones. By starting with the smallest debt and gradually working your way up, it allows you to experience quick wins and stay motivated on your journey towards financial freedom.

Creating a Budget and Debt Repayment Plan

When faced with the challenge of reducing your debt, it is essential to have a strategic approach that can pave the way for financial freedom. One effective method that individuals can employ is called the Debt Snowball Method.

The Debt Snowball Method involves creating a budget and debt repayment plan that focuses on paying off debts in a specific order. The primary goal is to gain momentum and motivation by starting with the smallest debts first, while making minimum payments on larger ones.

Here are the key steps to creating a budget and debt repayment plan using the Debt Snowball Method:

-

List Your Debts

Begin by listing all of your debts, including credit cards, loans, and any other outstanding balances. Arrange them in ascending order based on the amount owed, starting from the smallest to the largest.

-

Calculate Minimum Payments

Determine the minimum payment for each of your debts. This information can be found on your statements or by contacting your creditors directly.

-

Allocate Extra Funds

Review your monthly budget and identify any extra funds that can be allocated towards debt repayment. This could be achieved by cutting unnecessary expenses or finding additional sources of income.

-

Tackle the Smallest Debt

With the extra funds available, allocate the maximum amount possible to the smallest debt on your list while making minimum payments on the rest. Focus your efforts on completely eliminating this debt.

-

Rinse and Repeat

As you successfully pay off each debt, redirect the funds that were previously allocated to the eliminated debt towards the next smallest debt. Keep repeating this process until all of your debts are paid off.

By following the Debt Snowball Method and creating a budget and debt repayment plan, you can gain control over your finances and work towards a debt-free future. Stay committed, make adjustments to your budget when needed, and celebrate each small victory along the way.

Tackling the Smallest Debts First

In the world of debt reduction strategies, the debt snowball method has gained widespread popularity. This method emphasizes tackling the smallest debts first, regardless of interest rates or loan amounts. By focusing on smaller debts, individuals can experience quick wins and build momentum in their journey towards becoming debt-free.

One of the key advantages of the debt snowball method is its psychological impact. By eliminating smaller debts early on, individuals feel a sense of accomplishment and motivation to continue tackling their larger debts. This approach provides a psychological boost, creating a positive feedback loop that propels people forward.

Another benefit of this method is that it simplifies the debt reduction process. By focusing on one debt at a time, individuals can allocate their available resources and maximize their efforts towards paying off that debt. This targeted approach helps in avoiding feelings of overwhelm and ensures a clear path towards debt elimination.

Furthermore, the debt snowball method provides a tangible strategy for individuals to track their progress. As each small debt is paid off, individuals can visually see their list of debts shrinking. This visual representation acts as a constant reminder of their accomplishments and continues to spur them on their debt reduction journey.

While some argue that the debt snowball method may not be the most financially efficient approach due to ignoring interest rates, its effectiveness in terms of psychological wellbeing and motivation should not be underestimated. Ultimately, the choice of debt reduction strategy depends on individual circumstances and goals.

Building Momentum to Pay Off Larger Debts

When it comes to tackling your debt, having a strategic approach is crucial. One effective method that many individuals have used successfully is the Debt Snowball Method. This method involves paying off smaller debts first and then building momentum to tackle larger debts.

The Debt Snowball Method works by starting with the smallest debt owed and putting extra effort into paying it off completely. By focusing on smaller debts, you can quickly eliminate them and gain a sense of accomplishment. This early success boosts morale and motivates you to move on to the next debt.

As you pay off each debt, you take the money that was previously allocated for its monthly payment and apply it towards the next debt on your list. This creates a “snowball” effect where the amount available for debt repayment grows with each debt paid off. As the snowball gets bigger, you have more resources to tackle larger debts, which can be more daunting at first.

By consistently following the Debt Snowball Method, you are building momentum in your debt repayment journey. It provides a sense of progress and accomplishment, making the process more enjoyable and motivating. Additionally, as you pay off debts one by one, you gain financial freedom and reduce the overall interest paid over time.

In conclusion, the Debt Snowball Method is a strategic approach to debt reduction that emphasizes paying off smaller debts first to build momentum for tackling larger debts. By using this method, you can experience a tangible sense of progress and stay motivated throughout your debt repayment journey.

Conclusion

The Debt Snowball Method is a highly effective strategy for reducing debt. By paying off the smallest debts first and then using the money saved to tackle larger debts, individuals can gain momentum and motivation on their journey to becoming debt-free. This method not only provides a practical approach but also instills a sense of achievement and financial discipline along the way.